Within the rapidly evolving financial industry, where businesses come and go like the waves, one company, Cred, has successfully carved out a niche for itself while persevering through difficulties. Cred’s tale is about more than just changing credit card payments; it’s also about creativity, tenacity, and the ability to challenge the established quo.

Genesis of Cred

Every company has an origin story, a spark that kindles the creative fire. For Cred, it all began with the company’s visionary founder, Kunal Shah, who set out to change how people view and handle credit. With his prior experience co-founding the wildly successful digital payments platform Free Charge, Kunal’s story is nothing short of inspirational. Nonetheless, what really distinguished him was his vision for Cred.

With its 2018 introduction, Cred sought to solve a widespread problem with credit cards: a dearth of openness and user-friendly interfaces. The platform’s goal was to provide a fun and easy-to-use interface for managing credit card payments while also rewarding users for their prudent credit conduct.

Innovating the Credit Environment

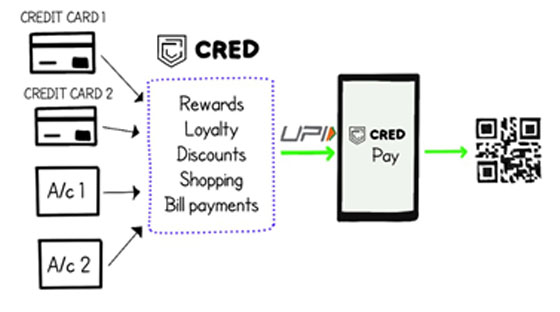

One of Cred’s most significant inventions is its capacity to transform the tedious and frequently unpleasant job of paying credit card bills into a fulfilling experience. The app gamifies the procedure in addition to combining all of your credit card payments into one location.

The brand’s dedication to providing a positive user experience is demonstrated by the interface’s elegance and simplicity. In addition to being quite aesthetically pleasing, the app’s design makes it very easy to use, especially for people who are not very knowledgeable about digital banking.

The Trust Challenge: Establishing Credibility

In the financial industry, trust is a valuable resource, and Cred recognized this difficulty from the start. The platform put strong security measures in place to build credibility and guarantee the security of users’ financial information. Cred’s status as a trustworthy middleman in the financial ecosystem was further enhanced by alliances with top banks and financial organizations.

Cred’s smooth user experience and openness in business practices further reinforced the trust relationship between the company and its users. Cred was able to close the trust gap in an industry where mistrust is commonplace by maintaining a steadfast commitment to security and openness.

Overcoming Obstacles with Resilience

There are always difficulties in a success story, and Cred is no different. The fintech industry is well known for being dynamic, with market swings, regulatory changes, and technological improvements acting as constant variables. Cred has shown incredible perseverance in overcoming these obstacles, though.

The brand’s success has been greatly attributed to its capacity to change with the ever changing banking industry. Cred has welcomed problems as chances for personal development rather of running from them. In addition to assisting them in overcoming obstacles, the team’s proactive approach to problem-solving has established Cred as a thought leader in the fintech industry.

Strategic Collaborations

Cred’s journey involves not only financial empowerment for individuals but also strategic partnerships that have helped the brand reach new heights. Leading financial institutions and the platform have partnered to create a win-win situation for all parties involved.

Cred has improved its services and broadened its market by working with banks and credit card firms. With the addition of customized financial solutions, exclusive offers, and discounts, Cred’s standing as a one-stop shop for all things credit-related is further cemented.

Marketing Strategy of Cred

Cred stands apart in the crowded financial market thanks to its innovative, user-friendly, and community-building marketing approach. Fundamentally, Cred uses a novel strategy to make a mundane task—paying credit card bills—a pleasurable one. By strategically rewarding users for making on-time payments, the platform promotes financial responsibility and builds a community of accountable consumers.

Cred’s dedication to customer involvement goes beyond transactions; with programmes like webinars, workshops, and a vibrant online community, the company helps users feel like they belong. Through its alliances with top financial institutions, the brand broadens its customer base and offers customized financial products and special promotions. Cred maintains its relevance in the fast-paced fintech industry by consistently developing and adjusting to changing consumer needs. Cred’s rise to prominence in the business may be attributed in large part to its customer-focused, community-focused, and inventive marketing approach.

Adapting to The Evolving Needs of Customers

The requirements and expectations of consumers change along with the financial landscape. Cred’s success has been greatly attributed to its capacity to adjust to these developments. The platform regularly rolls out new products and services in response to user input and developing financial trends.

For example, Cred enhanced its offerings to include a seamless credit card payment experience after realizing the increasing significance of digital payments. This action not only reflected the evolving desires of users, but it also established Cred as a progressive and innovative participant in the fintech space.

The Path Into The Future

Despite its tremendous voyage, Cred’s adventure is far from over. The company is always looking for new ways to innovate and grow. With an eye towards the future, Cred wants to expand the range of services it provides and might even go into areas like investing advice and personal finance management.

Cred’s success serves as a model for other fintech firms, emphasizing the value of persistence, creativity, and customer-centricity in the face of fierce competition. The brand’s development is evidence of the revolutionary potential that results from fusing technology with a keen grasp of customer wants.

Conclusion

To sum up, Cred’s story is more than just that of a fintech business; it’s a tale of creativity, tenacity, and a dedication to helping people on their financial path. Cred has demonstrated from the beginning to the present that success in the dynamic world of finance can be attained by rethinking conventional financial procedures and encouraging a community-centric mindset. Cred continues to be a shining example of inspiration for both customers and companies as the fintech sector develops.